Essay

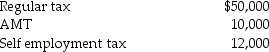

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $48,000.

Correct Answer:

Verified

a.The taxpayers should pay in...

a.The taxpayers should pay in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Ava has net earnings from self-employment of

Q10: Self-employed individuals are subject to the self-employment

Q15: Sam and Megan are married with two

Q17: A larger work opportunity credit is available

Q29: During the year,Jim incurs $500,000 of rehabilitation

Q36: ChocoHealth Inc.is developing new chocolate products providing

Q52: A taxpayer who paid AMT in prior

Q63: For purposes of the AMT,only the foreign

Q79: Bonjour Corp.is a U.S.-based corporation with operations

Q113: Tyler and Molly,who are married filing jointly