Multiple Choice

Daniel recognizes $35,000 of Sec.1231 gains and $25,000 of Sec.1231 losses during the current year.The only other Sec.1231 item was a $4,000 loss three years ago.This year,Daniel must report

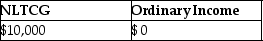

A)

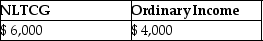

B)

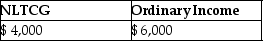

C)

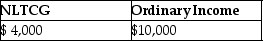

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q23: If the recognized losses resulting from involuntary

Q24: Heather purchased undeveloped land to drill for

Q56: An unincorporated business sold two warehouses during

Q59: Melissa acquired oil and gas properties for

Q66: Section 1250 does not apply to assets

Q70: For noncorporate taxpayers,depreciation recapture is not required

Q79: The amount recaptured as ordinary income under

Q88: An individual taxpayer sells a business building

Q91: Indicate whether each of the following assets

Q94: Costs of tangible personal business property which