Multiple Choice

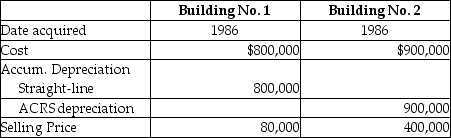

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for the first building and the accelerated method (ACRS) was used for the second building.Information about those buildings is presented below.  How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

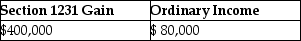

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

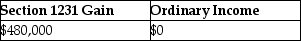

A)

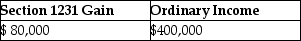

B)

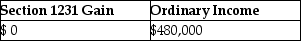

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In order to be considered Sec.1231 property,all

Q23: If the recognized losses resulting from involuntary

Q24: Heather purchased undeveloped land to drill for

Q52: Jesse installed solar panels in front of

Q53: Network Corporation purchased $200,000 of five-year equipment

Q59: Melissa acquired oil and gas properties for

Q60: Daniel recognizes $35,000 of Sec.1231 gains and

Q68: If the accumulated depreciation on business equipment

Q70: For noncorporate taxpayers,depreciation recapture is not required

Q94: Costs of tangible personal business property which