Multiple Choice

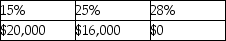

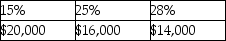

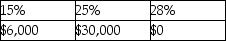

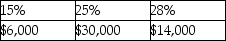

Yelenis,whose tax rate is 28%,sells one Sec.1231 asset this year,resulting in a $50,000 gain.Included in the $50,000 Sec.1231 gain is $30,000 of unrecaptured Sec.1250 gain.A review of Yelenis tax files for the past five years indicates one prior Sec.1231 sale which resulted in a $14,000 loss.The gain will be taxed as

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Section 1245 recapture applies to all the

Q6: Aamir has $25,000 of net Sec.1231 gains

Q9: The following gains and losses pertain to

Q11: An unincorporated business sold two warehouses during

Q12: When gain is recognized on an involuntary

Q16: Trena LLC,a tax partnership owned equally by

Q30: Elaine owns equipment ($23,000 basis and $15,000

Q33: If realized gain from disposition of business

Q81: For a business,Sec.1231 property does not include<br>A)timber,coal,or

Q87: When corporate and noncorporate taxpayers sell real