Multiple Choice

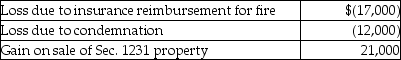

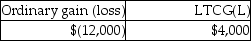

This year Jenna had the gains and losses noted below on property,plant and equipment used in her business.Each asset had been held longer than one year.Jenna has not previously disposed of any business assets.  Jenna will recognize

Jenna will recognize

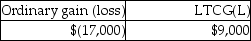

A)

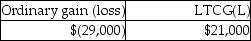

B)

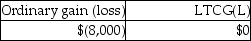

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Four years ago,Otto purchased farmland for $600,000

Q12: Cobra Inc.sold stock for a $25,000 loss

Q23: Blair,whose tax rate is 28%,sells one tract

Q28: With respect to residential rental property<br>A)80% or

Q57: In 1980,Mr.Lyle purchased a factory building to

Q63: Which of the following assets is 1231

Q70: Lucy,a noncorporate taxpayer,experienced the following Section 1231

Q71: On June 1,2013,Buffalo Corporation purchased and placed

Q79: Section 1231 property will generally have all

Q1297: Sarah owned land with a FMV of