Essay

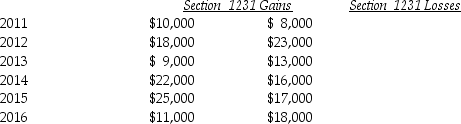

Lucy,a noncorporate taxpayer,experienced the following Section 1231 gains and losses during the years 2011 through 2016.Her first disposition of a Sec.1231 asset occurred in 2011.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Four years ago,Otto purchased farmland for $600,000

Q22: Emily,whose tax rate is 28%,owns an office

Q45: Gain recognized on the sale or exchange

Q57: In 1980,Mr.Lyle purchased a factory building to

Q66: The following gains and losses pertain to

Q67: A business plans to sell its office

Q71: On June 1,2013,Buffalo Corporation purchased and placed

Q75: This year Jenna had the gains and

Q79: The amount recaptured as ordinary income under

Q1297: Sarah owned land with a FMV of