Essay

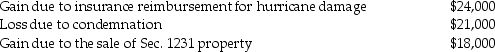

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Correct Answer:

Verified

The $24,000 casualty gain is treated as ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Emily,whose tax rate is 28%,owns an office

Q23: If the recognized losses resulting from involuntary

Q45: Gain recognized on the sale or exchange

Q66: Section 1250 does not apply to assets

Q67: A business plans to sell its office

Q70: Lucy,a noncorporate taxpayer,experienced the following Section 1231

Q71: On June 1,2013,Buffalo Corporation purchased and placed

Q79: The amount recaptured as ordinary income under

Q88: An individual taxpayer sells a business building

Q91: Indicate whether each of the following assets