Essay

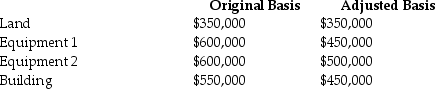

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000.Each asset was purchased in 2012 and is used in a trade or business.There are no other gains and losses and no nonrecaptured Section 1231 losses.

Correct Answer:

Verified

• Land: $150,000 Section 1231 gain taxed...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: A corporation owns many acres of timber,which

Q6: A corporation owns many acres of timber,which

Q31: Gains and losses from involuntary conversions of

Q38: Marta purchased residential rental property for $600,000

Q105: All of the following statements are true

Q108: Depreciable property used in a trade or

Q109: Julie sells her manufacturing plant and land

Q110: In 1980,Artima Corporation purchased an office building

Q111: Octet Corporation placed a small storage building

Q113: During the current year,Danika recognizes a $30,000