Essay

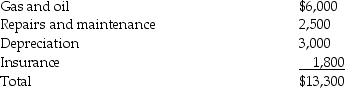

Sarah purchased a new car at the beginning of the year.She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2015 for employment-related business miles.She incurs the following expenses related to both business and personal use:  She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Correct Answer:

Verified

Actual expense method:  Standard mileage...

Standard mileage...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Employees receiving nonqualified stock options recognize ordinary

Q66: Martin Corporation granted an incentive stock option

Q67: Shane,an employee,makes the following gifts,none of which

Q70: Dighi,an artist,uses a room in his home

Q85: A sole proprietor will not be allowed

Q103: Chuck, who is self- employed, is scheduled

Q114: A tax adviser takes a client to

Q117: Norman traveled to San Francisco for four

Q150: The following individuals maintained offices in their

Q190: Why did Congress establish Health Savings Accounts