Multiple Choice

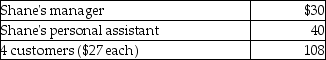

Shane,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

A) $125

B) $150

C) $75

D) $178

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Employees receiving nonqualified stock options recognize ordinary

Q39: Wilson Corporation granted an incentive stock option

Q66: Martin Corporation granted an incentive stock option

Q69: Sarah purchased a new car at the

Q70: Dighi,an artist,uses a room in his home

Q85: A sole proprietor will not be allowed

Q103: Chuck, who is self- employed, is scheduled

Q117: Norman traveled to San Francisco for four

Q134: The maximum tax deductible contribution to a

Q190: Why did Congress establish Health Savings Accounts