Multiple Choice

Austin incurs $3,600 for business meals while traveling for his employer,Tex,Inc.Austin is reimbursed in full by Tex pursuant to an accountable plan.What amounts can Austin and Tex deduct?

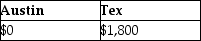

A)

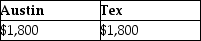

B)

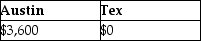

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Tyne is a 48-year-old an unmarried taxpayer

Q11: Martin Corporation granted a nonqualified stock option

Q12: Ron obtained a new job and moved

Q13: An employer receives an immediate tax deduction

Q14: Richard traveled from New Orleans to New

Q31: Which of the following is true about

Q35: Explain when educational expenses are deductible for

Q37: Unreimbursed employee business expenses are deductions for

Q43: An accountant takes her client to a

Q66: A partnership plans to set up a