Multiple Choice

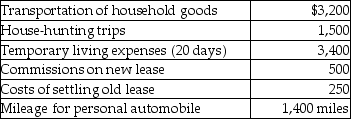

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

A) $3,522

B) $6,600

C) $9,172

D) $8,422

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Austin incurs $3,600 for business meals while

Q11: Martin Corporation granted a nonqualified stock option

Q13: An employer receives an immediate tax deduction

Q14: Richard traveled from New Orleans to New

Q23: Josiah is a human resources manager of

Q31: Which of the following is true about

Q35: Explain when educational expenses are deductible for

Q37: Unreimbursed employee business expenses are deductions for

Q41: Gambling losses are miscellaneous itemized deductions subject

Q66: A partnership plans to set up a