Essay

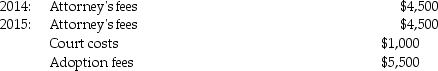

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2015,incurred the following expenses in their efforts to adopt a child:  The adoption was finalized in 2015.What is the amount of the allowable adoption credit in 2015?

The adoption was finalized in 2015.What is the amount of the allowable adoption credit in 2015?

Correct Answer:

Verified

Qualifying expense:  Less upper income p...

Less upper income p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: If estimated tax payments equal or exceed

Q41: With respect to estimated tax payments for

Q47: Beth and Jay project the following taxes

Q55: In 2015 Rita is divorced with one

Q56: Sonya started a self-employed consulting business in

Q57: The foreign tax credit is equal to

Q57: Medical expenses in excess of 10% of

Q122: Refundable tax credits<br>A)only offset a taxpayer's tax

Q130: In computing AMTI,adjustments are<br>A)limited.<br>B)added only.<br>C)subtracted only.<br>D)either added

Q200: Describe the differences between the American Opportunity