Essay

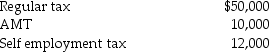

Beth and Jay project the following taxes for the current year:  How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Correct Answer:

Verified

a.The taxpayers should pay in...

a.The taxpayers should pay in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Sam and Megan are married with two

Q41: With respect to estimated tax payments for

Q44: Lee and Whitney incurred qualified adoption expenses

Q46: Annie has taxable income of $100,000,a regular

Q52: Tyler and Molly,who are married filing jointly

Q57: The foreign tax credit is equal to

Q99: Casualty and theft losses in excess of

Q122: Refundable tax credits<br>A)only offset a taxpayer's tax

Q130: In computing AMTI,adjustments are<br>A)limited.<br>B)added only.<br>C)subtracted only.<br>D)either added

Q131: Tanya has earnings from self-employment of $240,000,resulting