Essay

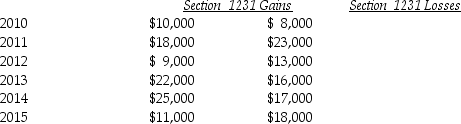

Lucy,a noncorporate taxpayer,experienced the following Section 1231 gains and losses during the years 2010 through 2015.Her first disposition of a Sec.1231 asset occurred in 2010.Assuming Lucy had no capital gains and losses during that time period,what is the tax treatment in each of the years listed?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: An unincorporated business sold two warehouses during

Q5: Frisco Inc.,a C corporation,placed a building in

Q9: The following gains and losses pertain to

Q12: Pam owns a building used in her

Q12: Melissa acquired oil and gas properties for

Q15: Maura makes a gift of a van

Q38: Marta purchased residential rental property for $600,000

Q92: Gains and losses resulting from condemnations of

Q94: Costs of tangible personal business property which

Q111: Octet Corporation placed a small storage building