Multiple Choice

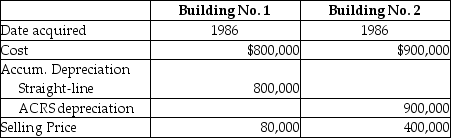

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for the first building and the accelerated method (ACRS) was used for the second building.Information about those buildings is presented below.  How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

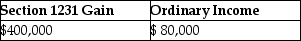

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture by the owner of the business?

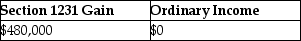

A)

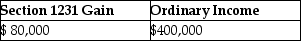

B)

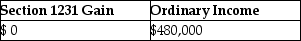

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Frisco Inc.,a C corporation,placed a building in

Q8: Lucy,a noncorporate taxpayer,experienced the following Section 1231

Q9: The following gains and losses pertain to

Q12: Pam owns a building used in her

Q15: Maura makes a gift of a van

Q38: Marta purchased residential rental property for $600,000

Q72: Sec.1245 can increase the amount of gain

Q92: Gains and losses resulting from condemnations of

Q94: Costs of tangible personal business property which

Q109: Hilton,a single taxpayer in the 28% marginal