Essay

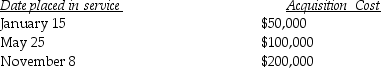

Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property in 2015 and does not use Sec.179.Mehmet places the property in service on the following schedule:  What is the total depreciation for 2015?

What is the total depreciation for 2015?

Correct Answer:

Verified

More than 40% of the assets a...

More than 40% of the assets a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Harrison acquires $65,000 of 5-year property in

Q10: In April of 2014,Brandon acquired five-year listed

Q12: Greta,a calendar-year taxpayer,acquires 5-year tangible personal property

Q24: Once the business use of listed property

Q25: When a taxpayer leases an automobile for

Q34: On January l Grace leases and places

Q38: Land,buildings,equipment,and common stock are examples of tangible

Q61: The election to use ADS is made

Q80: The basis of an asset must be

Q87: The straight-line method may be elected for