Essay

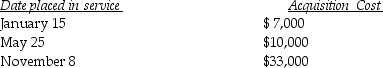

Greta,a calendar-year taxpayer,acquires 5-year tangible personal property in 2015 and places the property in service on the following schedule:  Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $190,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2015?

Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $190,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2015?

Correct Answer:

Verified

Because Sec.179 expensing is ...

Because Sec.179 expensing is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property

Q10: In April of 2014,Brandon acquired five-year listed

Q15: Fred purchases and places in service in

Q24: Once the business use of listed property

Q31: The mid-quarter convention applies to personal and

Q34: On January l Grace leases and places

Q38: Land,buildings,equipment,and common stock are examples of tangible

Q53: Under what circumstances might a taxpayer elect

Q80: The basis of an asset must be

Q87: The straight-line method may be elected for