Multiple Choice

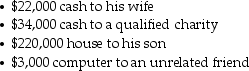

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

A) $206,000.

B) $214,000.

C) $234,000.

D) $279,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A progressive tax rate structure is one

Q12: Firefly Corporation is a C corporation.Freya owns

Q20: Gifts made during a taxpayer's lifetime may

Q27: Flow-through entities do not have to file

Q30: Thomas dies in the current year and

Q34: Horizontal equity means that<br>A)taxpayers with the same

Q36: Brad and Angie had the following income

Q37: The unified transfer tax system<br>A)imposes a single

Q48: A proportional tax rate is one where

Q90: During the current tax year,Charlie Corporation generated