Essay

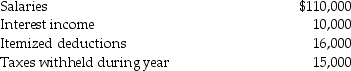

Brad and Angie had the following income and deductions during 2015:  Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

Tax = $10,312.50 + .25(96,000...

Tax = $10,312.50 + .25(96,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: A progressive tax rate structure is one

Q12: Firefly Corporation is a C corporation.Freya owns

Q20: Gifts made during a taxpayer's lifetime may

Q27: Flow-through entities do not have to file

Q34: Horizontal equity means that<br>A)taxpayers with the same

Q35: Paul makes the following property transfers in

Q37: The unified transfer tax system<br>A)imposes a single

Q40: If a taxpayer's total tax liability is

Q48: A proportional tax rate is one where

Q90: During the current tax year,Charlie Corporation generated