Essay

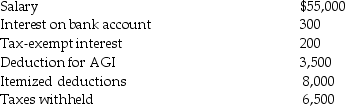

Chris,a single taxpayer,had the following income and deductions during 2015:  Calculate Chris's tax liability due or refund for 2015.

Calculate Chris's tax liability due or refund for 2015.

Correct Answer:

Verified

Tax $5,156.25 + .25(39,800 - ...

Tax $5,156.25 + .25(39,800 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q19: Which of the following is not an

Q21: For gift tax purposes,a $14,000 annual exclusion

Q23: The IRS must pay interest on<br>A)all tax

Q24: Which of the following serves as the

Q55: The primary liability for payment of the

Q63: The Senate equivalent of the House Ways

Q64: What are the correct monthly rates for

Q74: Peyton has adjusted gross income of $2,000,000

Q80: All states impose a state income tax

Q93: Which of the following is not one