Multiple Choice

What are the correct monthly rates for calculating failure to file and failure to pay penalties?

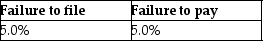

A)

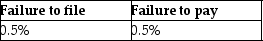

B)

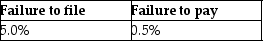

C)

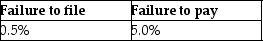

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Which of the following taxes is regressive?<br>A)Federal

Q8: What is an important aspect of a

Q19: Which of the following is not an

Q21: For gift tax purposes,a $14,000 annual exclusion

Q23: The IRS must pay interest on<br>A)all tax

Q46: In an S corporation,shareholders<br>A)are taxed on their

Q57: Limited liability companies may elect to be

Q69: Chris,a single taxpayer,had the following income and

Q93: Which of the following is not one

Q103: An individual will be subject to gift