Multiple Choice

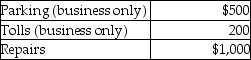

Chelsea, who is self-employed, drove her automobile a total of 20,000 business miles in 2014. This represents about 75% of the auto's use. She has receipts as follows:  Chelsea has an AGI for the year of $50,000. Chelsea uses the standard mileage rate method. After application of any relevant floors or other limitations, she can deduct

Chelsea has an AGI for the year of $50,000. Chelsea uses the standard mileage rate method. After application of any relevant floors or other limitations, she can deduct

A) $10,900.

B) $11,900.

C) $11,750.

D) $12,900.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: All of the following are true with

Q11: Tobey receives 1,000 shares of YouDog! stock

Q23: Josiah is a human resources manager of

Q38: Tucker (age 52)and Elizabeth (age 48)are a

Q50: The deduction for unreimbursed transportation expenses for

Q67: Charles is a self-employed CPA who maintains

Q69: Corporations issuing incentive stock options receive a

Q72: Rajiv, a self-employed consultant, drove his auto

Q81: Richard traveled from New Orleans to New

Q641: If an employee incurs travel expenditures and