Multiple Choice

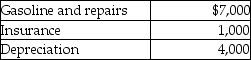

Rajiv, a self-employed consultant, drove his auto 20,000 miles this year, 15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

Rajiv's AGI is $100,000 before considering the auto costs. Rajiv has used the actual cost method in the past. What is Rajiv's deduction for the use of the auto after application of all relevant limitations?

A) $8,325

B) $9,000

C) $6,325

D) $7,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Personal travel expenses are deductible as miscellaneous

Q8: All of the following are true with

Q9: All taxpayers are allowed to contribute funds

Q19: Which of the following conditions would generally

Q23: Josiah is a human resources manager of

Q38: Tucker (age 52)and Elizabeth (age 48)are a

Q50: The deduction for unreimbursed transportation expenses for

Q61: Hannah is a 52-year-old an unmarried taxpayer

Q77: Travel expenses related to temporary work assignments

Q77: Chelsea, who is self-employed, drove her automobile