Multiple Choice

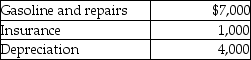

Jordan, an employee, drove his auto 20,000 miles this year, 15,000 to meetings with clients and 5,000 for commuting and personal use. The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer, and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer, and the employer paid a reimbursement of $ .50 per mile. Jordan has used the actual cost method in the past. Jordan's AGI is $50,000. What is Jordan's deduction for the use of the auto after application of all relevant limitations?

A) $1,500

B) $500

C) $1,000

D) $8,000

Correct Answer:

Verified

Correct Answer:

Verified

Q26: In a defined contribution pension plan,fixed amounts

Q28: Raul and Jenna are married and are

Q39: Wilson Corporation granted an incentive stock option

Q43: An accountant takes her client to a

Q56: Transportation expenses incurred to travel from one

Q62: Tyne is a 48-year-old an unmarried taxpayer

Q86: Donald takes a new job and moves

Q87: Sarah purchased a new car at the

Q144: Hunter retired last year and will receive

Q1643: Johanna is single and self- employed as