Essay

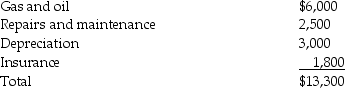

Sarah purchased a new car at the beginning of the year. She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2014 for employment-related business miles. She incurs the following expenses related to both business and personal use:

She also spent $200 on parking and tolls that were related to business. During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business. During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Correct Answer:

Verified

Actual expense method:

Standard mileag...

Standard mileag...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: In a defined contribution pension plan,fixed amounts

Q28: Raul and Jenna are married and are

Q39: Wilson Corporation granted an incentive stock option

Q43: An accountant takes her client to a

Q56: Transportation expenses incurred to travel from one

Q67: Charles is a self-employed CPA who maintains

Q83: Shane, an employee, makes the following gifts,

Q86: Donald takes a new job and moves

Q89: Jordan, an employee, drove his auto 20,000

Q1643: Johanna is single and self- employed as