Multiple Choice

Austin incurs $3,600 for business meals while traveling for his employer, Tex, Inc. Austin is reimbursed in full by Tex pursuant to an accountable plan. What amounts can Austin and Tex deduct?

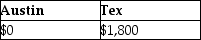

A)

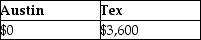

B)

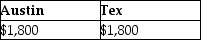

C)

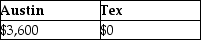

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: A contributor may make a deductible contribution

Q31: Which of the following is true about

Q32: Jack takes a $7,000 distribution from his

Q37: Unreimbursed employee business expenses are deductions for

Q96: In which of the following situations is

Q106: Ron obtained a new job and moved

Q110: Martin Corporation granted a nonqualified stock option

Q116: Ron is a university professor who accepts

Q122: Gwen traveled to New York City on

Q1609: Daniel has accepted a new job and