Multiple Choice

Martin Corporation granted a nonqualified stock option to employee Caroline on January 1, 2011. The option price was $150, and the FMV of the Martin stock was also $150 on the grant date. The option allowed Caroline to purchase 1,000 shares of Martin stock. The option itself does not have a readily ascertainable FMV. Caroline exercised the option on August 1, 2014 when the stock's FMV was $250. If Caroline sells the stock on September 5, 2015 for $300 per share, she must recognize

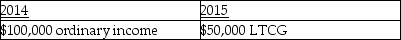

A)

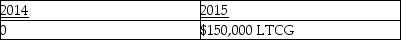

B)

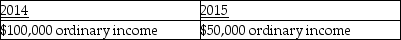

C)

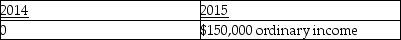

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Which of the following is true about

Q37: Unreimbursed employee business expenses are deductions for

Q96: In which of the following situations is

Q106: Ron obtained a new job and moved

Q108: Austin incurs $3,600 for business meals while

Q114: A tax adviser takes a client to

Q116: Ron is a university professor who accepts

Q122: Gwen traveled to New York City on

Q128: Tyler (age 50)and Connie (age 48)are a

Q1609: Daniel has accepted a new job and