Multiple Choice

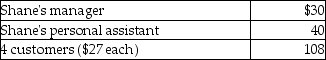

Shane, an employee, makes the following gifts, none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

A) $125

B) $150

C) $75

D) $178

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Tobey receives 1,000 shares of YouDog! stock

Q26: In a defined contribution pension plan,fixed amounts

Q39: Wilson Corporation granted an incentive stock option

Q67: Charles is a self-employed CPA who maintains

Q69: Corporations issuing incentive stock options receive a

Q81: Richard traveled from New Orleans to New

Q86: Donald takes a new job and moves

Q87: Sarah purchased a new car at the

Q641: If an employee incurs travel expenditures and

Q1643: Johanna is single and self- employed as