Essay

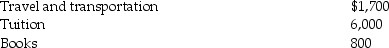

Ellie, a CPA, incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a. If Ellie is self-employed, what are the amount of and the nature of the deduction for these expenses?

b. If, instead, Ellie is an employee who is not reimbursed by his employer, what are the amount of and the nature of the deduction for these expenses (after limitations)?

Correct Answer:

Verified

a. $1,700 + $6,000 + $800 = $8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Which of the following statements is incorrect

Q59: A sole proprietor establishes a Keogh plan.The

Q66: A partnership plans to set up a

Q82: Jason,who lives in New Jersey,owns several apartment

Q86: Taxpayers may use the standard mileage rate

Q92: Which of the following statements regarding Coverdell

Q114: A tax adviser takes a client to

Q122: West's adjusted gross income was $90,000. During

Q125: Bill obtained a new job in Boston.

Q373: A taxpayer goes out of town to