Multiple Choice

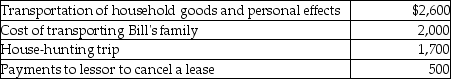

Bill obtained a new job in Boston. He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses, what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses, what is the amount of the deduction?

A) $2,600

B) $4,600

C) $6,300

D) $6,800

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q34: Nonqualified deferred compensation plans can discriminate in

Q55: In-home office expenses for an office used

Q66: A partnership plans to set up a

Q82: Jason,who lives in New Jersey,owns several apartment

Q120: Ellie, a CPA, incurred the following deductible

Q122: West's adjusted gross income was $90,000. During

Q129: Steven is a representative for a textbook

Q151: If an employee incurs business-related entertainment expenses

Q373: A taxpayer goes out of town to

Q1326: Gina is an instructor at State University