Multiple Choice

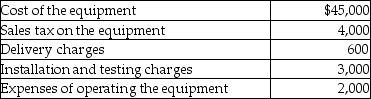

During the current year, Tony purchased new car wash equipment for use in his service station business. Tony's costs in connection with the new equipment this year were as follows:  What is Tony's basis in the car wash equipment?

What is Tony's basis in the car wash equipment?

A) $49,000

B) $49,600

C) $52,600

D) $54,600

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q19: During the current year, Nancy had the

Q28: On January 31 of this year,Jennifer pays

Q50: If property received as a gift has

Q78: Kathleen received land as a gift from

Q91: Generally,gains resulting from the sale of collectibles

Q95: Armanti received a football championship ring in

Q99: In a community property state,jointly owned property

Q104: The holding period of property received from

Q2205: What are arguments for and against preferential