Multiple Choice

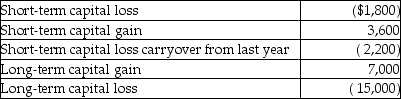

During the current year, Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year, and what is the amount and character of her capital loss carryover?

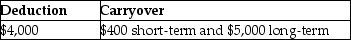

A)

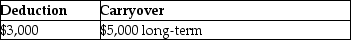

B)

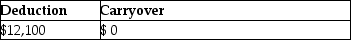

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q20: During the current year, Tony purchased new

Q28: On January 31 of this year,Jennifer pays

Q50: If property received as a gift has

Q78: Kathleen received land as a gift from

Q84: David gave property with a basis of

Q91: Generally,gains resulting from the sale of collectibles

Q99: In a community property state,jointly owned property

Q104: The holding period of property received from

Q2205: What are arguments for and against preferential