Essay

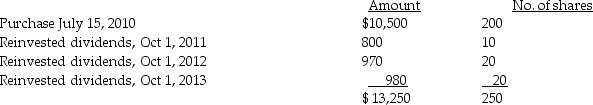

Joy purchased 200 shares of HiLo Mutual Fund on July 15, 2009, for $10,500, and has been reinvesting dividends. On December 15, 2014, she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Correct Answer:

Verified

Assuming FIFO, the basis in th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: The initial adjusted basis of property depends

Q64: Unlike an individual taxpayer,the corporate taxpayer does

Q69: Tina, whose marginal tax rate is 33%,

Q70: Topaz Corporation had the following income and

Q82: An uncle gifts a parcel of land

Q90: Capitalization of interest is required if debt

Q92: Dale gave property with a basis of

Q105: If a capital asset held for one

Q120: Antonio owns land held for investment with

Q136: Stella has two transactions involving the sale