Essay

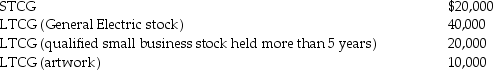

Tina, whose marginal tax rate is 33%, has the following capital gains this year:

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Funds borrowed and used to pay for

Q41: The initial adjusted basis of property depends

Q67: Joy purchased 200 shares of HiLo Mutual

Q70: Topaz Corporation had the following income and

Q82: An uncle gifts a parcel of land

Q90: Capitalization of interest is required if debt

Q91: How long must a capital asset be

Q105: If a capital asset held for one

Q120: Antonio owns land held for investment with

Q136: Stella has two transactions involving the sale