Multiple Choice

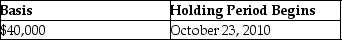

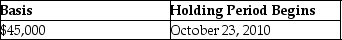

On April 4, 2014, Joan contributes business equipment (she had purchased on October 23, 2010) having a $45,000 FMV and a $40,000 adjusted basis to the EJK Partnership in exchange for a 25% interest in the capital and profits. The basis of the property and the date the holding period begins for the partnership is

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q9: S corporation shareholders who own more than

Q10: Separately stated items are allocated to the

Q28: The corporate built-in gains tax does not

Q47: Many professional service partnerships have adopted the

Q77: Which of the following assets may cause

Q80: A business distributes land to one of

Q98: An S corporation distributes land to its

Q101: Mark receives a nonliquidating distribution of $10,000

Q137: Which of the following is not a

Q1122: Payton and Eli form the EP Partnership