Essay

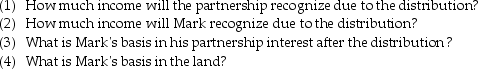

Mark receives a nonliquidating distribution of $10,000 cash and a parcel of land having an adjusted basis of $18,000 and a fair market value of $25,000.

a. Mark's basis in his partnership interest prior to the distribution is $50,000.

b. Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

b. Assume Mark's basis in his partnership interest is instead $22,000 and redetermine the responses to questions (1)through (4).

Correct Answer:

Verified

Correct Answer:

Verified

Q9: S corporation shareholders who own more than

Q10: Separately stated items are allocated to the

Q47: Many professional service partnerships have adopted the

Q57: Under the "check-the-box" Treasury Regulations,an LLC with

Q77: Which of the following assets may cause

Q98: An S corporation distributes land to its

Q103: On April 4, 2014, Joan contributes business

Q137: Which of the following is not a

Q1122: Payton and Eli form the EP Partnership

Q1594: Discuss how the partnership form of organization