Multiple Choice

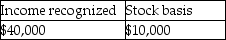

Tony is the 100% shareholder of a corporation established five years ago. It has always been an S corporation. After adjustment for this year's corporate income, but before taking distributions into account, Tony has a $50,000 stock basis. The corporation pays Tony a $40,000 cash distribution. As a result of this distribution, Tony will have an ending stock basis and recognize income of

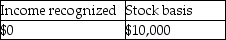

A)

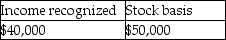

B)

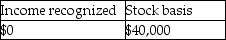

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Ben is a 30% partner in a

Q41: Shelley owns a 25% interest in a

Q49: In the syndication of a partnership,brokerage and

Q68: If a partner contributes depreciable property to

Q99: Hal transferred land having a $160,000 FMV

Q123: Atiqa receives a nonliquidating distribution of land

Q127: The AAA Partnership makes an election to

Q137: All the following are types of pass-through

Q904: Hildi and Frank have decided to form

Q1399: Elise contributes property having a $60,000 FMV