Essay

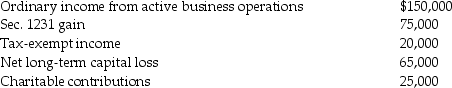

The AAA Partnership makes an election to be an Electing Large Partnership. The partnership reports the following activities:

What are the amounts reported by AAA to the partners on Schedule K-1 for inclusion on their individual tax returns?

What are the amounts reported by AAA to the partners on Schedule K-1 for inclusion on their individual tax returns?

Correct Answer:

Verified

The net Sec 1231 gain of $75,000 is trea...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Ben is a 30% partner in a

Q9: A contribution of services to a partnership

Q41: Shelley owns a 25% interest in a

Q49: In the syndication of a partnership,brokerage and

Q68: If a partner contributes depreciable property to

Q99: Hal transferred land having a $160,000 FMV

Q123: Atiqa receives a nonliquidating distribution of land

Q129: Tony is the 100% shareholder of a

Q904: Hildi and Frank have decided to form

Q1399: Elise contributes property having a $60,000 FMV