Essay

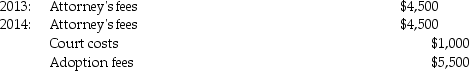

Tyler and Molly, who are married filing jointly with $210,000 of AGI in 2014, incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2014. What is the amount of the allowable adoption credit in 2014?

The adoption was finalized in 2014. What is the amount of the allowable adoption credit in 2014?

Correct Answer:

Verified

Qualifying expense:

Less upper income ...

Less upper income ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: Nonrefundable credits may offset tax liability but

Q41: With respect to estimated tax payments for

Q51: Harley's tentative minimum tax is computed by

Q75: Evan and Barbara incurred qualified adoption expenses

Q84: Tom and Anita are married, file a

Q86: Reva and Josh Lewis had alternative minimum

Q88: Ivan has generated the following taxes and

Q93: Joe,who is single with modified AGI of

Q108: Individuals without children are eligible for the

Q117: Sonya started a self-employed consulting business in