Essay

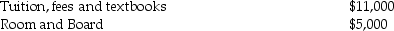

Tom and Anita are married, file a joint return with an AGI of $165,000, and have one dependent child, Tim, who is a first-time freshman in college. The following expenses are incurred and paid in 2014:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

Tim is eligible for the American Opportu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Lavonne has a regular tax liability of

Q51: Harley's tentative minimum tax is computed by

Q52: A taxpayer who paid AMT in prior

Q69: The general business credits are refundable credits.

Q75: Evan and Barbara incurred qualified adoption expenses

Q88: Ivan has generated the following taxes and

Q89: Tyler and Molly, who are married filing

Q112: Nonrefundable tax credits<br>A)only offset a taxpayer's tax

Q117: Sonya started a self-employed consulting business in

Q126: Which of the following statements is incorrect