Multiple Choice

Daniel recognizes $35,000 of Sec. 1231 gains and $25,000 of Sec. 1231 losses during the current year. The only other Sec. 1231 item was a $4,000 loss three years ago. This year, Daniel must report

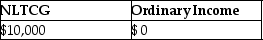

A)

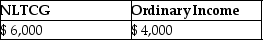

B)

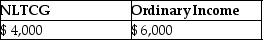

C)

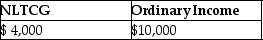

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: A corporation owns many acres of timber,which

Q9: Eric purchased a building in 2003 that

Q15: Maura makes a gift of a van

Q20: The following are gains and losses recognized

Q31: Gains and losses from involuntary conversions of

Q45: Gain recognized on the sale or exchange

Q51: In 2014,Thomas,who has a marginal tax rate

Q61: WAM Corporation sold a warehouse during the

Q86: Pierce has a $16,000 Section 1231 loss,a

Q91: Brian purchased some equipment in 2014 which