Essay

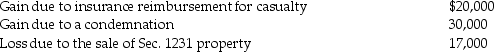

The following are gains and losses recognized in 2014 on Ann's business assets that were held for more than one year. The assets qualify as Sec. 1231 property.

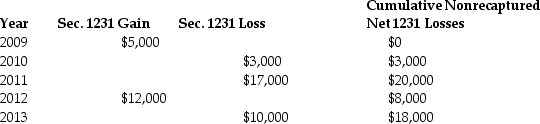

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec. 1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Correct Answer:

Verified

The $20,000 gain from the casualty is tr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: In order to be considered Sec.1231 property,all

Q9: Eric purchased a building in 2003 that

Q24: Daniel recognizes $35,000 of Sec. 1231 gains

Q31: Gains and losses from involuntary conversions of

Q51: In 2014,Thomas,who has a marginal tax rate

Q52: If a taxpayer has gains on Sec.1231

Q58: Unrecaptured 1250 gain is the amount of

Q61: WAM Corporation sold a warehouse during the

Q91: Brian purchased some equipment in 2014 which

Q109: Hilton,a single taxpayer in the 28% marginal