Multiple Choice

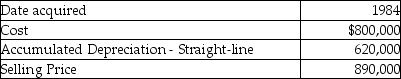

A corporation sold a warehouse during the current year. The straight-line depreciation method was used. Information about the building is presented below:  How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The following gains and losses pertain to

Q1: Section 1245 recapture applies to all the

Q17: All of the following statements are true

Q20: Melissa acquired oil and gas properties for

Q23: If the recognized losses resulting from involuntary

Q34: A net Sec.1231 gain is treated as

Q70: Mark owns an unincorporated business and has

Q85: The sale of inventory results in ordinary

Q91: Indicate whether each of the following assets

Q102: Pete sells equipment for $15,000 to Marcel,his