Essay

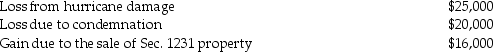

The following gains and losses pertain to Arnold's business assets that qualify as Sec. 1231 property. Arnold does not have any nonrecaptured net Sec. 1231 losses from previous years, and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Section 1245 recapture applies to all the

Q4: A corporation sold a warehouse during the

Q17: All of the following statements are true

Q20: Melissa acquired oil and gas properties for

Q23: If the recognized losses resulting from involuntary

Q34: A net Sec.1231 gain is treated as

Q70: Mark owns an unincorporated business and has

Q85: The sale of inventory results in ordinary

Q91: Indicate whether each of the following assets

Q102: Pete sells equipment for $15,000 to Marcel,his