Essay

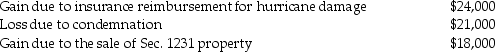

The following gains and losses pertain to Jimmy's business assets that qualify as Sec. 1231 property. Jimmy does not have any nonrecaptured net Sec. 1231 losses from previous years, and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Correct Answer:

Verified

The $24,000 casualty gain is treated as ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Installment sales of depreciable property which result

Q21: If Section 1231 applies to the sale

Q37: During the current year,Hugo sells equipment for

Q40: During the current year,a corporation sells equipment

Q40: Julie sells her manufacturing plant and land

Q41: An unincorporated business sold two warehouses during

Q72: Sec.1245 can increase the amount of gain

Q77: The purpose of Sec.1245 is to eliminate

Q87: When corporate and noncorporate taxpayers sell real

Q92: Gains and losses resulting from condemnations of