Essay

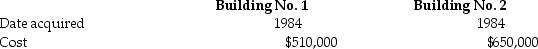

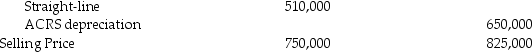

An unincorporated business sold two warehouses during the current year. The straight-line depreciation method was used for Building No. 1 and the accelerated method (ACRS)was used for Building No. 2. Information about those buildings is presented below.

Accum. Depreciation

Accum. Depreciation

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

Correct Answer:

Verified

Building No. 2 is co...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: All of the following are considered related

Q9: Installment sales of depreciable property which result

Q31: Cassie owns equipment ($45,000 basis and $30,000

Q37: The following gains and losses pertain to

Q37: During the current year,Hugo sells equipment for

Q40: Julie sells her manufacturing plant and land

Q66: Section 1250 does not apply to assets

Q72: Sec.1245 can increase the amount of gain

Q77: The purpose of Sec.1245 is to eliminate

Q92: Jesse installed solar panels in front of