Multiple Choice

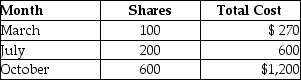

Edward purchased stock last year as follows:  In April of this year, Edward sells 80 shares for $250. Edward cannot specifically identify the stock sold. The basis for the 80 shares sold is

In April of this year, Edward sells 80 shares for $250. Edward cannot specifically identify the stock sold. The basis for the 80 shares sold is

A) $160.

B) $184.

C) $216.

D) $240.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Five different capital gain tax rates could

Q17: On July 25,2014,Marilyn gives stock with a

Q26: Arthur,age 99,holds some stock purchased many years

Q33: On January 1 of this year,Brad purchased

Q47: Trista, a taxpayer in the 33% marginal

Q49: Max sold the following capital assets this

Q50: Nate sold two securities in 2015: <img

Q52: Dennis purchased a machine for use in

Q66: Melanie,a single taxpayer,has AGI of $220,000 which

Q119: Margaret died on September 16,2015,when she owned