Multiple Choice

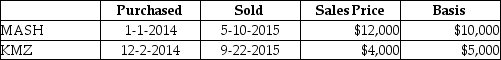

Nate sold two securities in 2015:  Nate has a 25% marginal tax rate. What is the additional tax resulting from the above sales?

Nate has a 25% marginal tax rate. What is the additional tax resulting from the above sales?

A) $150

B) $200

C) $300

D) $400

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Five different capital gain tax rates could

Q17: On July 25,2014,Marilyn gives stock with a

Q26: Arthur,age 99,holds some stock purchased many years

Q33: On January 1 of this year,Brad purchased

Q47: Trista, a taxpayer in the 33% marginal

Q49: Max sold the following capital assets this

Q51: Edward purchased stock last year as follows:

Q52: Dennis purchased a machine for use in

Q66: Melanie,a single taxpayer,has AGI of $220,000 which

Q81: Jordan paid $30,000 for equipment two years