Multiple Choice

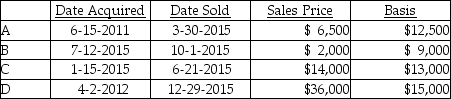

Coretta sold the following securities during 2015:  What is Coretta's net capital gain or loss result for the year?

What is Coretta's net capital gain or loss result for the year?

A) NSTCL of $3,000 and NLTCG of $15,000

B) $9,000 ANCG

C) $0

D) $12,000 ANCG

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q12: Funds borrowed and used to pay for

Q15: The taxable portion of a gain from

Q33: In 2011 Toni purchased 100 shares of

Q47: Allison buys equipment and pays cash of

Q49: Gina owns 100 shares of XYZ common

Q68: Abra Corporation generated $100,000 of taxable income

Q76: Because of the locked-in effect,high capital gains

Q89: Chen had the following capital asset transactions

Q116: Andrea died with an unused capital loss